Retail Media Networks: Essential Insights You Shouldn’t Miss

Retail media networks (RMNs) are gaining traction in the marketing landscape, even though their origins can be traced back to traditional advertising methods, such as brands placing ads on store shelves and funding prominent placements in retailers’ promotional materials. However, the digital transformation has catapulted RMNs into a new era.

Today, RMNs are becoming a significant aspect of both current and future digital marketing strategies.

- Present Situation. Walmart Connect, the RMN of Walmart, accounts for 12% of the organization’s profits. According to Forrester, around a quarter of retailers are now making upwards of $100 million from their media networks. Retail margins are typically narrow, ranging from 3% to 4%, while advertising margins can soar to between 70% and 90%, as stated by BCG.

- Future Outlook. Investment in RMNs is anticipated to surge at a rate of 25% annually, eventually reaching $100 billion within five years, making up over 25% of total digital media outlays by 2026, according to BCG. Notably, 60% to 70% of this revenue will be net new spending, exceeding traditional advertising funds.

According to Michael Greene, the Senior Vice President of Vertical Strategy at Criteo, “There are two aspects that seem to contradict each other yet are both true: This is the most significant trend in advertising today while simultaneously being an area that’s still quite immature.” He notes that almost all retailers dealing with third-party brands are engaged in this trend, from established players like Amazon, which has integrated RMNs into its primary business strategy, to newer entrants into the field.

Greene further elaborates on the immaturity of the sector, indicating that brands have primarily invested according to the trajectories of early adopters rather than aligning with where consumer interest truly resides.

Table of Contents

Defining Retail Media Networks

In essence, retail media networks serve as platforms that allow brands to purchase advertising space on a retailer’s digital assets, encompassing websites, applications, and physical stores. Notably, this also facilitates ad placements across the broader internet. By leveraging comprehensive shopper data, retailers can collaborate with media companies to offer brands expanded visibility and enhanced targeting capabilities.

What was previously considered a minor adjunct to marketing efforts has swiftly evolved into a primary focus for brands and retailers.

“Our objective is to foster more meaningful connectivity between our partners and customers,” explains Charlene Charles, the head of Dollar General’s DG Media Network Operations. “Brands are eager to engage customers and provide them with the best products, whether it’s cereal or personal care items. Our goal is to reach consumers in rural areas who can be hard to access… ensuring they find the brands and products they truly want. This approach is integral to our mission of serving our communities, but it is now being facilitated through a new channel.”

The Value of RMNs for Retailers

A prime illustration of a successful retail media network is Dollar General, which has cultivated strong ties with consumers who are often overlooked in other marketing channels. With over 18,000 locations, 75% of its stores are situated in markets with populations of 20,000 or fewer. This unique positioning allows Dollar General to provide brands access to invaluable first-party consumer data, which is precisely what many brands seek.

“When evaluating impression volume, what tends to happen is it gets concentrated in major urban areas,” notes Charles. “But we have the capacity to reach 90% of our customer base through paid media, effectively expanding our coverage in rural regions.”

Explore Further: Marriott’s Entry into Media Retail Networks

In turn, Dollar General can present attractive offers and discounts to its customers, enhancing loyalty and experience—while simultaneously reaping significant financial benefits.

Though Dollar General does not disclose precise revenue figures from its media network, it is likely substantial. Walmart Connect, for instance, contributes around 12% to Walmart’s profits. According to Forrester, a quarter of retailers are pulling in over $100 million from their media endeavors. This shift has been transformative for many retailers, providing a vital revenue source amidst economic challenges. Typical retail profit margins range from 3% to 4%, whereas ad sales margins can reach 70% to 90%, according to BCG, marking outstanding performance.

Insights from MediaRadar reveal the following:

- Over 23,500 advertisers utilized RMNs between May 1, 2021, and the end of January 2022.

- 14% engaged with ads monthly, with a retention rate of 59% from December to January.

- In January 2022, 24% of advertisers were first-time participants.

Moreover, predictions indicate that the retail media market will expand by 25% annually, reaching $100 billion in five years, representing more than 25% of total digital media expenditure by 2026, according to BCG. Importantly, this income represents new revenue streams for retailers, with 60% to 70% of the anticipated $100 billion in 2026 being brand new expenditure, beyond traditional advertising funds.

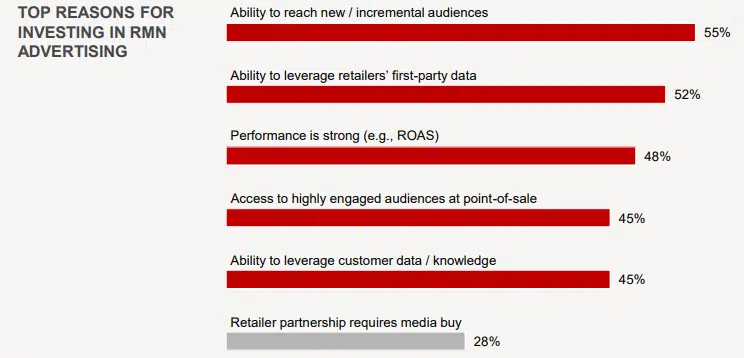

The Value of RMNs for Brands

Retail media networks offer brands more than just first-party data; they also streamline the process of linking advertising expenditure directly to sales outcomes. The close proximity of online ads to point-of-sale locations means purchases can easily be traced back to specific advertisements, providing vital analytical support for strategic decision-making and ROI evaluations.

However, brands may face hurdles, notably regarding integration with new media networks: What processes are required for ad sales? Is it compatible with existing technology? Additionally, assessing if the retailer’s data meets the brand’s needs—whether it offers a unique reach or the required depth—is crucial.

The emergence of retail media networks has transformed retailers into advertising powerhouses, leading to significant changes within the industry that are still being understood. This shift is also fueling innovation as marketers rush to take advantage of these networks, both in digital and physical spaces.

“Previously, in-store advertising was limited to printed materials or static displays,” Feczko notes. “Now, it has evolved into an exciting digital domain featuring elements like cooler displays.”

For instance, Walgreens employs screens on cooler units that accurately show the contents behind the glass while concurrently promoting specific brands or offers as customers deliberate on their purchases.

Despite the surge in RMN popularity, there is a risk that the proliferation of these networks might lead to an oversupply that outpaces market demand. Nevertheless, they are currently providing significant advantages for both marketers and retailers.

Challenges Associated with RMNs

Although the potential of RMNs is substantial, caution is advised as these channels carry inherent complexities. As Michael Greene remarked, “This represents the most significant movement in advertising today, but it remains a relatively immature sector. Numerous retailers are engaging in this space, but there’s a broad spectrum of experience levels, from industry veterans like Amazon to newer players.”

The primary obstacle lies in the absence of standardized systems and measurement protocols. An IAB study from 2023 highlighted that nearly 70% of RMN users identified “complicated buying processes” as the top barrier to growth, followed by 62% who cited a lack of standard measurement practices.

Brands and agencies that were previously purchasing from a limited number of RMNs have now expanded their engagement to dozens or even hundreds of diverse retailers globally. Unlike traditional digital ad publishers, RMNs lack uniformity across numerous aspects, including ad size and format, as well as integration with programmatic advertising platforms.

“A unique challenge within the retail media domain, compared to traditional publishing, is that while conventional publishers primarily depend on ad revenue, retailers are simultaneously managing product sales as their main revenue source,” explains Greene. “This leads to a balancing act where retailers strive to create an advertising experience that complements product sales while ensuring that the buying process remains straightforward for brands, preventing them from needing to reinvent their creative strategies for every campaign.”

Solutions to RMN Challenges

The good news is that all parties have a shared motivation to address these challenges: revenue growth.

This January, the IAB collaborated with the Media Rating Council (MRC) to unveil the IAB/MRC Retail MediaMeasurement Guidelines. (For an informative overview, click here.)

The guidelines focus on four primary areas:

- Transparency and consistency: Establishing clear definitions and methodologies to facilitate metric comparisons among stakeholders.

- Accuracy and reliability: Utilizing dependable methodologies to reduce errors and adapt to changing market dynamics.

- Privacy and security: Adhering to privacy laws such as GDPR and CCPA and implementing stringent data protection protocols.

- Compliance with industry standards: Aligning with best practices set by organizations such as MRC and IAB.

Ensuring data accuracy: The guidelines advocate for the regular calibration and validation of RMN measurement tools and methodologies. Additionally, RMNs should maintain uniform data collection protocols for both internal evaluations and audits. They are also prompted to reference the IAB Tech Lab’s Spiders and Bots List to eliminate invalid traffic and compare data against established benchmarks for bias and inaccuracies.

This cooperative approach, alongside the newly implemented guidelines, is likely to foster rapid solutions to the technical hurdles faced by RMNs.

Further Resources

- Key Insights for Brands and Retailers Regarding RMNs

- How Home Depot and Kroger Enhance Shopper Experiences with RMNs

- 88% of Brands Report Pressure to Utilize Retailers’ Media Networks

- Retailers Investing in GenAI and Media Networks

- IAB Introduces New Guidelines as Retail Media Networks Evolve

- Strategies for Small Chains to Scale via Retail Media Networks

Email:

See terms.

OptiPrime – Global leading total performance marketing “mate” to drive businesses growth effectively. Elevate your business with our tailored digital marketing services. We blend innovative strategies and cutting-edge technology to target your audience effectively and drive impactful results. Our data-driven approach optimizes campaigns for maximum ROI.

Spanning across continents, OptiPrime’s footprint extends from the historic streets of Quebec, Canada to the dynamic heartbeat of Melbourne, Australia; from the innovative spirit of Aarhus, Denmark to the pulsating energy of Ho Chi Minh City, Vietnam. Whether boosting brand awareness or increasing sales, we’re here to guide your digital success. Begin your journey to new heights with us!